For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

As we navigate through 2023, India's cybersecurity landscape presents a complex tapestry of challenges and advancements. The country has witnessed a series of significant cyber incidents, including major data breaches in government sectors and the exploitation of emerging technologies by cybercriminals. A notable event was the breach of the Ministry of Health and Family Welfare's Health Management Information System, which put sensitive data across the nation's hospitals at risk.

The cybersecurity market in India, valued at USD 3.97 billion in 2023, is expected to grow to USD 9.21 billion by 2028, a testament to the increasing awareness and investment in this field. This growth is driven by the rising demand for scalable IT infrastructure and the frequency of targeted cyberattacks. The need for enhanced cybersecurity is further underscored by the fact that over 37% of Indian businesses had their digital infrastructure hosted on the cloud in 2020, with expectations of this number rising significantly in 2023.

Emerging cyberthreats in 2023 include the exploitation of popular software and applications, misuse of AI tools for phishing attacks, IoT vulnerabilities, and the alarming trend of fake loan apps. These threats highlight the urgent need for regular software updates and rigorous digital hygiene practices. Amidst these challenges, India's response has been proactive, with collaborations between national security agencies and the Defence Cyber Agency for rigorous cyber defense exercises, and initiatives like the National Counter Ransomware Task Force reflecting India's commitment to countering specific threats like ransomware.

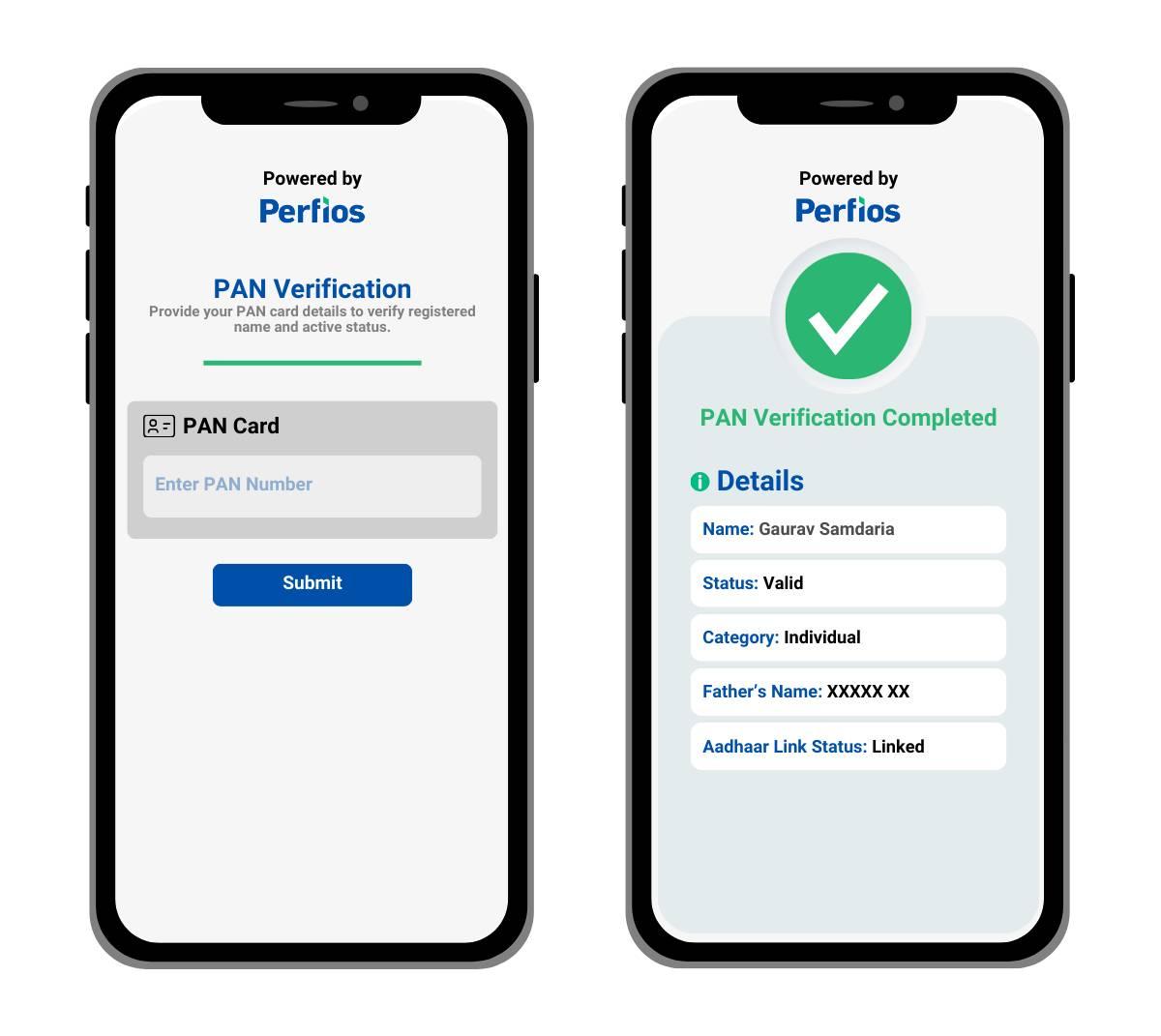

In this intricate and ever-evolving cyber landscape, the role of PAN verification for protecting identity and financial data becomes paramount. As we delve deeper into this topic, we will explore how advanced solutions like Perfios' PAN Verification API are not just responding to these challenges but are also shaping the future of cybersecurity in PAN verification in India.

Permanent Account Number (PAN) serves as a cornerstone in the financial and administrative architecture. As a unique identifier for each individual and entity, PAN is integral to a multitude of financial transactions and identity verification processes.

In the banking and financial sector, PAN is indispensable. It's mandatory for opening bank accounts, securing loans, conducting high-value transactions, and managing foreign currency exchanges. The significance of PAN here lies in its role as a vital identity document, aiding banks in customer verification, minimizing fraud risk, and ensuring adherence to regulatory compliance.

The role of PAN stretches into the real estate domain as well, where it acts as a transparency mechanism in property transactions. For purchases beyond a certain threshold, quoting PAN is compulsory for both buyers and sellers, fostering accountability and aiding in curbing illicit financial flows.

In the stock market and broader investment landscape, PAN's relevance is equally pronounced. It is a prerequisite for individuals participating in securities trading, ensuring the tracking of entities involved and promoting fair market operations. Similarly, for government contracts and tenders, PAN serves as a mandatory requirement, ensuring transparent and accountable procurement processes.

Furthermore, PAN is a key element in combating financial crimes, such as money laundering, where it functions as a reliable identifier in anti-money laundering (AML) measures. PAN verification allows institutions to scrutinize transaction patterns, irregularities, and potential threats, thereby reinforcing the financial system's integrity.

Additionally, PAN is vital in the Know Your Customer (KYC) processes. Financial entities integrate PAN authentication within their KYC practices to maintain transparency, mitigate risks, and uphold the integrity of the financial ecosystem.

The pervasive use of PAN in various sectors underlines its multifaceted role in the financial landscape of India. From banking, real estate, and investments to government tenders and AML compliance, PAN stands as a pivotal component in ensuring financial transparency and regulatory adherence. This multifunctionality not only streamlines financial processes but also fortifies the framework against fraudulent activities and identity theft.

As India progresses digitally, its cybersecurity landscape is increasingly challenged by sophisticated cyber threats. In 2023, the nation witnessed alarming cybersecurity incidents, including one of the largest data breaches ever, where personal information of over 800 million Indian citizens was put up for sale on the dark web. This breach compromised sensitive data like Aadhaar details and passport information, underscoring the urgent need for augmented cybersecurity measures.

The cybersecurity landscape in 2023 is marked by evolving threats, with CERT-In identifying vulnerabilities in popular software like Microsoft Windows and Google Chrome, exposing millions to the risk of data theft. The misuse of AI tools for crafting phishing attacks presents another major concern, illustrating the complexity of modern cyber threats. Additionally, the rising trend of fake loan apps exploiting personal data demonstrates the extent to which cybercriminals can manipulate digital systems.

India's response to these challenges includes collaborations between national security agencies and the Defence Cyber Agency, highlighting a proactive stance against cyberthreats. However, the statistics are stark - India faced an average of 2,108 cyber attacks per week in the first quarter of 2023, significantly higher than the global average. This situation highlights the critical importance of robust cybersecurity measures in protecting sensitive information like PAN details from increasingly sophisticated and frequent cyber attacks.

The cybersecurity considerations for 2023 emphasize the need for a data-centric future and securing digital trust. As PAN verification processes become more digitized, they must adapt to these evolving cybersecurity challenges. Implementing strategies such as zero trust, Secure Access Service Edge (SASE), and cybersecurity mesh models are crucial for safeguarding PAN data against cyber threats and maintaining the integrity of financial systems.

India's technology sector is witnessing significant advancements, particularly in digital transformation, cybersecurity, cloud computing, AI, and analytics. These technologies are increasingly integrated into PAN verification processes to enhance security and efficiency. The focus on hyper-automation and virtual experiences is driving new business growth and optimization, with an emphasis on domain specialization and purpose-driven partnerships in technology services.

The strategic integration of these advanced technologies in PAN API aligns with the broader trends in India's technology sector. Enterprises are focusing on digital customer experience (CX), digitization, cloudification, and platformization. There is also an increasing demand for quality talent in niche tech areas like cloud, AI/ML, and natural language processing (NLP), emphasizing the need for reskilling and upskilling to meet the evolving requirements of the technology landscape.

The integration of these technological advancements in PAN verification processes is essential for keeping up with the dynamic digital economy. It not only enhances the security and accuracy of the verification process but also aligns with the global standards of digital transformation and cybersecurity. As India continues to grow its technology sector, these advancements are expected to play a pivotal role in the evolution of financial services, including PAN verification.

Perfios' PAN Verification API marks a significant advancement in identity verification for 2023. This real-time verification tool connects directly to government databases, ensuring swift and accurate validation of Permanent Account Numbers (PAN). The API's standout feature is its AI-based OCR technology, which extracts and verifies PAN details from various documents, streamlining the onboarding and verification process. By integrating GST verification, the API also aids in ensuring compliance with GST regulations by performing PAN number checks.

Designed to prevent fraud and adhere to compliance, Perfios' PAN Verification API is an essential tool for financial institutions, online merchants, insurance companies, fintech startups, and government agencies. This API not only enhances the precision and efficiency of identity verification processes but also integrates seamlessly into existing systems, offering a customizable, user-friendly experience that aligns with the needs of various industries.

The future of cybersecurity in PAN verification is shaped by the rapid evolution of digital technologies and the growing sophistication of cyber threats. In 2023, we have seen the significant influence of Artificial Intelligence (AI) in the cybersecurity landscape. AI's adaptive capabilities are fortifying defenses, offering proactive shields against evolving threats. However, AI is a double-edged sword, as attackers leverage it to craft more sophisticated assaults. The balance of ensuring responsible AI use without oversharing sensitive data is paramount in securing digital frontiers.

The cybersecurity landscape is also being shaped by the increasing connectivity of devices and systems through the Internet of Things (IoT). With IoT and open-source vulnerabilities, cyber insurance and risk assessment models are evolving. This development drives insurers to adapt their risk models and impose conditions on the insured, such as requiring automated cyber hygiene for non-IT devices and systems.

Generative AI is becoming a universal risk factor, being rapidly built into various tools. With its growth, there's a potential for unexpected vulnerabilities, especially considering free and paid access to generative AI for everyone. This situation increases the risk of insider threat-style data leaks and elevates the general threat level, as more malicious code can be churned out even faster.

Furthermore, the focus on API security has gained prominence due to the rapid pace of development outpacing available security resources, leading to overlooked vulnerabilities. Organizations are encouraged to foster collaboration between security and engineering teams and integrate security tests early in development pipelines for better API security.

The concept of Zero Trust is increasingly relevant in the context of cybersecurity. This approach involves continuous verification of every user and device, aligning with the shifting nature of work and digital interactions. Zero Trust models are becoming integral to managing and mitigating cybersecurity risks more effectively.

The future of cybersecurity in PAN verification is set to be increasingly dynamic, with AI and IoT at the forefront of new developments. The focus will likely be on adapting to these technologies, enhancing API security, and implementing Zero Trust frameworks to address the sophisticated and evolving cyber threats. This approach is crucial for safeguarding sensitive data like PAN details and maintaining the integrity of financial systems in the digital age.

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo