For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

Making Insurance Companies Digital-Ready

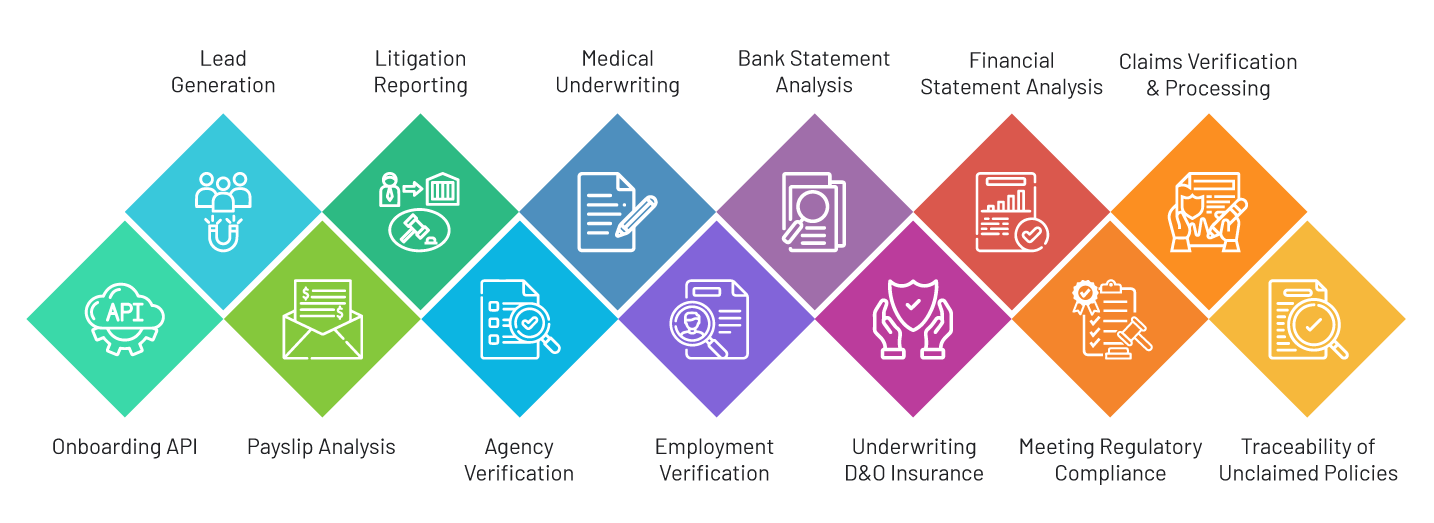

Can you sell insurance to customers in less than two minutes, including secure KYC verification? Do you have a foolproof claim management process for general, life, and health insurance? If yes, then you are championing the next era of insurance transformation. If not, Perfios is here to help! Perfios empowers insurance companies to transform their onboarding, underwriting, and claim management processes through its comprehensive suite of industry-leading solutions.

Perfios APIs help verify customer information using an extensive database from 800+ sources. Insurance companies can verify and validate declarations and Proofs in real time. As a next-leap insurance customers can now onboard using Perfios Account Aggregator framework.

Our easy-to-use litigation platform automates the screening and generation of reports on businesses and individuals, leveraging data gathered across 3500+ courts and tribunals in India. Our comprehensive coverage and daily data updates ensure that we can provide accurate and updated case identification, tagging, analytics, and report generation services.

For complete financial profiling of your customers, we have offerings that not only cover regulatory requirements but also give you accurate data to avoid any fraudulent sale of insurance policies. With one click you can get insights from bank statement analysis, income verification, repayment track record, ITR form 16, 26 As, employment verification, creditworthiness, AML clearance, and more!

Our KYC verification during onboarding of insurance customers applies deep-tech infused cognitive features such as liveness check, OCR, and face match to support mobile, browsers, and messenger apps enabled offline KYC document photo check, and IP spoofing checks, among others. The onboarding process is 100% RBI-compliant.

Perfios works with ‘Always, Customer First’ approach. Did you know Perfios serves more than 900+ financial institutions? And that has made us understand that digital transformations can be expensive, so we have always strived to provide the best solutions at the lowest costs.

Our solutions are used by the top insurance companies in India. Our APIs and SDKs are the most comprehensive, and we are known for swift implementation and faster go-live.