For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

A medical claim is a bill submitted by a patient or a patient’s healthcare provider to their insurer. This bill contains detailed information regarding the treatment received by the patient including:

- Diagnoses

- Procedures

- Investigations

- Medications

- Medical supplies

- Medical devices

- Medical transportation

- Fees

Insurers use the claim to assess its legitimacy and the payout that the patient or healthcare provider is entitled to.

1. Cashless Claim: Insurance companies have tie-ups with various hospitals, which are called network hospitals. Some policies offer cashless treatment facilities to the policyholder. In this event, the hospital or other healthcare facility files a claim directly with the insurer while the patient does not incur any out of pocket expense.

2. Reimbursement Claims: If the patient undergoes treatment at a hospital that is not in the insurance company’s network, they will have to bear the expenses for their treatment out of pocket, and then file for reimbursement with their insurer under their policy.

Medical claims processing is every action that proceeds from the submission of a medical claim by a patient or the patient’s healthcare provider to the insurer and precedes claims settlement and payout to the patient or healthcare provider by the insurer. This is a critical step where insurance providers assess the claim, verify its legitimacy, calculate payouts and approve disbursal of the settlement amount.

Following intimation by the hospital or policyholder, the hospital sends the claims details to the insurer or to a Third Party Administrator (TPA) who reformats the claims and sends the relevant documents to the insurer. The TPA or insurer receives the filled out claim form, medical bills and reports, discharge summary, prescription and medical certificate and identity proof. Medical claims processing then typically involves the following steps:

- Verify patient details including name, policy number, DoB

- Ensure the patient had coverage at the time of service

- Assess whether the hospital is within the insurer’s network or not

- Verify patient eligibility for medical services including services covered under their plan including - exclusions, co-pay, deductibles, out-of-pocket limits, etc.

- Confirm the details of the treatment and their necessity for the diagnosis - Medically necessary treatments are of note for calculating insurance coverage

- Check for fraudulent claims, aberrant procedures and excessive charges

- Calculate the payout

- Communicate the decision to the patient or healthcare provider

Claims processing is performed by a professional known as an Insurance Assessor or Claims Assessor. The process is almost completely manual, with each claim involving a mountain of paperwork and requiring hours of data cleaning, reformatting and preparation before even being assessed. A claim can take anywhere up to 15 days to complete and settle as a result.

Claims processing is an effort-intensive step that involves a huge amount of data, multiple touchpoints, and a large degree of back-and-forth communication between multiple stakeholders that raises the likelihood of errors or miscommunication leading to delays in claims processing. A claims assessor can take upwards of a few hours simply to reformat the claim documentation and data, some of which may be scanned copies of handwritten prescriptions or bills. Moreover, identifying fraud, waste and abuse (FWA) makes all the difference in an industry where profits hover between 2-3 percent. It is estimated that 10-12 percent of claims could be fraudulent. The repetitive nature of manual claims assessment can create gaps in FWA detection.

In a time when insurance coverage is expanding swiftly and the demand for skilled labor cannot keep pace, manual processing lacks the scalability needed to offer a seamless experience for policyholders.

Insurers are resorting to multiple solutions partners offering piecemeal capabilities that carry high hidden costs in the form of disparate systems and data requirements, and partner evaluation and onboarding expenses. Problems with these solutions include:

1. Data debt: Claims are not submitted in a standard format. E-PDFs, handwritten bills and prescriptions and non-standard hospital submissions can be submitted as part of the same claim. Inevitably, some data is lost in translation.

2. OCR/Digitization degradation: OCR can struggle with rotation, skewing, distortion, low quality images and noise (streaks, watermarks, stamps, etc. that are not part of the text).

3. Decisioning issues: Business rules engines can be cumbersome to configure for new use cases, and black-box decisioning can increase the likelihood of errors and requirement for quality audits when inputs evolve.

4. Evolution: Insurance is a constantly evolving environment and new formats, new data, new rules and new standards are the norm, and require coordinated configuration across multiple systems.

On the balance, the elimination of human touch points requires the elimination of the requirement for human decisioning. This is the critical capability missing in most “claims processing automation solutions”. The need of the hour is a solution that evolves and scales regardless of changing markets, regulations and patterns of fraud, waste and abuse.

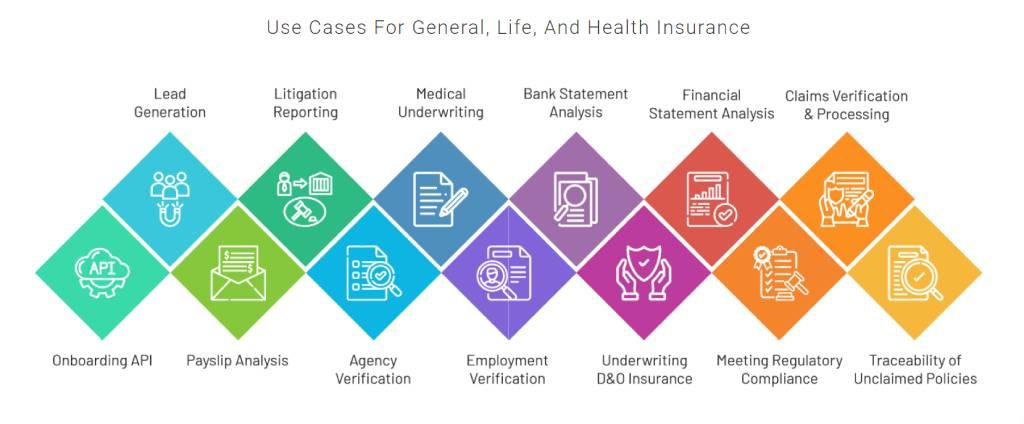

Perfios Acclaim and PerSieve provide category-first capabilities in claims processing and FWA detection. Perfios provides end-to-end solutions across the insurance cycle, from sourcing leads to tracing unclaimed policies.

Perfios places a premium on easy API integration with client systems. Any update or reconfiguration requires no effort from the client. We offer a seamless bridge between claims sources and insurer systems.

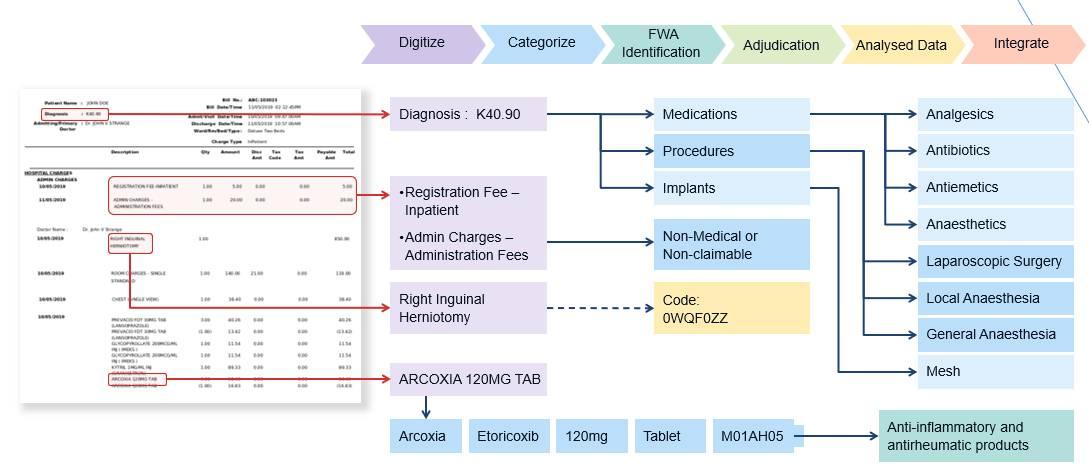

1. 100% accurate digitization: We support any hospital or clinic format, cashless and reimbursement claims and regional languages. Our AI-based solutions easily and instantly categorize claims data into treatment and expense groups.

2. Complete automation: We offer claims automation, auto-adjudication, pluggable rules for policies and providers, automated detection of policy limits and exclusions, and non-covered items.

3. Flags for fraud, waste and abuse: Our ML solution detects and flags excessive treatments, unnecessary treatments and missed treatments, and flags them up for review. Missed X-rays? Wrong medication for diagnosed condition? Our model catches on instantly.

We integrate and aggregate data sources including those of insurance and healthcare providers, medical databases and classification systems including ATC, LOINC, ICD and SNOMED. We even train our models on drug price benchmarks and doctor-wise compliance reports to provide the industry’s most robust fraud detection system. Our insurance products are developed by the most tenured brains in the insurance and medical industries, with centuries of collective experience between them.

Claims processing and underwriting require a serious overhaul as the IRDAI moves to pull every single Indian citizen under the protective cover of insurance. Insurers will have to move quickly to adopt end-to-end solutions that completely eliminate human touch points from the claims process and ensure seamless customer experience. Selecting technology partners that bring a deep-rooted understanding of and connections in the insurance industry will provide unparalleled convenience and competitive advantage.

See more of our thoughts on the insurance sector on the links below:

1. https://www.perfios.com/post/pivc-facilitating-iron-clad-agreements-in-india-s-insurance-sector

2. https://www.perfios.com/post/onboarding-insurance-agents-here-are-the-how-s-and-why-s

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in Bangalore, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com.

For more information on our solutions, contact us at https://solutions.perfios.com/request-for-demo