For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

In the realm of financial markets, the Securities and Exchange Board of India (SEBI) stands as a pivotal regulator ensuring the smooth functioning and integrity of the securities market. Established in 1992, SEBI's primary objective is to protect the interests of investors in securities, promote the development of, and regulate the securities market to foster a climate of trust and compliance.

A cornerstone of this trust is the implementation of robust Know Your Customer (KYC) norms, which are crucial for ensuring a compliant and trustworthy market ecosystem. KYC norms are a series of verification processes that financial institutions must undergo to ascertain the identity of their clients. This is instrumental in preventing fraud, money laundering, and ensuring a transparent market where all participants operate under a veil of legitimacy.

In recent times, digital transformation has significantly impacted the KYC landscape, leading to the evolution of digital KYC processes. Among the many directives from SEBI, the KYC norms have continuously been refined to align with the changing dynamics of the market and technological advancements. The most recent stride in this direction is the issuance of the new Master Circular on KYC norms, dated October 12, 2023. This Master Circular consolidates all KYC circulars till September 30, 2023, providing a streamlined framework for market participants to adhere to.

The hallmark of this updated framework is the emphasis on digital KYC processes, including in-person verification through video, online submission of officially valid documents, and the use of electronic/digital signatures including Aadhaar e-Sign. This progressive move not only aligns with the global trend towards digitalization but also significantly enhances the ease and efficiency of compliance procedures, setting a new standard for identity verification in the Indian securities market.

The trajectory of KYC norms in India has witnessed a metamorphosis over the years, mirroring the global shifts towards more stringent and technologically driven verification processes. The inception of KYC norms can be traced back to the early 2000s when the financial sector began to feel the imperative need for a structured verification process to curb financial malfeasance.

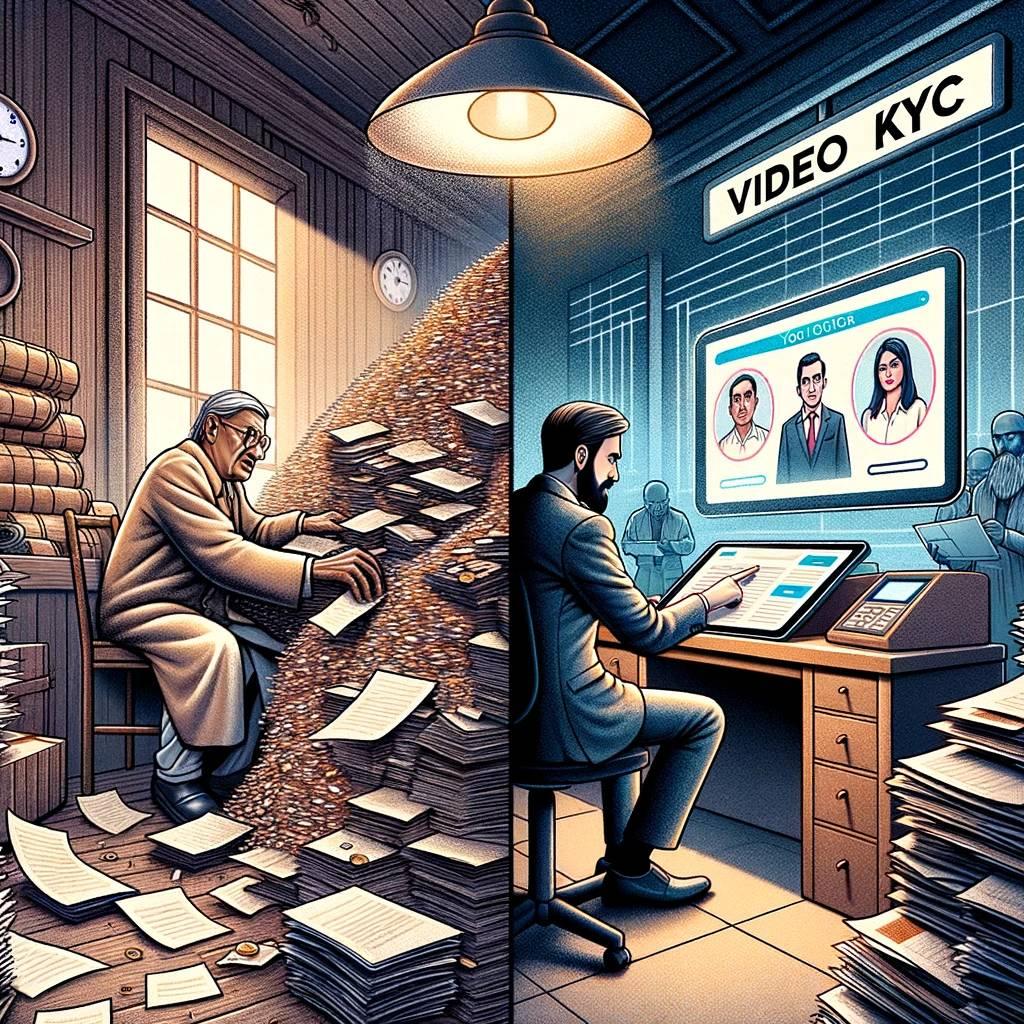

Initially, KYC procedures were manual and paper-driven, involving a substantial amount of time and resources. However, the proliferation of digital technology gradually began to reshape the KYC landscape, introducing more efficient and secure methods of identity verification.

The transition towards digital KYC was catalyzed further by the global financial crises and the subsequent tightening of regulatory frameworks around the world. The emphasis shifted towards creating a more transparent and compliant market ecosystem to safeguard against financial fraud and to uphold market integrity.

In India, the push towards digital KYC gained momentum with the advent of Aadhaar, a 12-digit unique identity number issued by the Unique Identification Authority of India (UIDAI) to residents of India. The integration of Aadhaar with KYC processes significantly streamlined the verification procedures, paving the way for digital KYC.

SEBI, aligning with these technological advancements and regulatory trends, has been proactive in revising and updating the KYC norms to maintain pace with the evolving market dynamics. The introduction of Video KYC, as outlined in the recent Master Circular on KYC norms 2023, is a testament to SEBI's commitment to leveraging digital technology for enhancing market compliance and efficiency. The new guidelines underscore the shift towards a more modernized, digital, and user-friendly KYC process, aligning India's financial market with global standards12.

Moreover, the global pandemic accelerated the need for remote verification processes, making Video KYC a timely and relevant solution. The ease of conducting KYC verifications remotely not only ensures continued compliance but also facilitates seamless transactions in the securities market, thus fostering a conducive environment for market growth and investor participation.

The digital era has ushered in a plethora of advancements, making processes more streamlined and user-friendly. In this vein, the Securities and Exchange Board of India (SEBI) has unveiled its updated Know Your Client (KYC) norms, encapsulated in the Master Circular dated October 12, 2023, which consolidates all previous KYC circulars up till September 30, 20231. This section aims to provide a succinct overview of these revised guidelines, emphasizing the Video KYC aspect, which is a significant leap towards digitalization and enhanced compliance in the Indian securities market.

The revised KYC norms underscore the importance of leveraging digital technology for conducting client verification. The guidelines stipulate that the client's KYC shall be completed through digital means, encompassing online or app-based KYC processes, in-person verification through video, online submission of officially valid documents, and the use of electronic or digital signatures including Aadhaar e-Sign2. This digital-centric approach not only streamlines the KYC process but also aligns with the global trend of utilizing technology to bolster compliance and reduce operational inefficiencies.

A notable facet of these guidelines is the implementation of Video KYC, which allows for in-person verification to be conducted remotely. This is particularly pertinent in the current social distancing era, where remote operations have become the norm rather than the exception. Video KYC provides a secure, efficient, and convenient platform for both financial institutions and their clients, enhancing the ease of doing business while ensuring stringent compliance with regulatory mandates.

Furthermore, the Bombay Stock Exchange (BSE) issued a notification on 21st April 2023, in pursuance of the amendment to SEBI KYC Registration Agency (KRA) Regulations, 2011, outlining additional guidelines for KYC processes. This notification underscores the process to be followed when a client's KYC records are not validated by the KRA, elucidating that such clients would be permitted to transact in the securities market only post-validation of their KYC.

These guidelines set a new precedent in the KYC domain, melding technological innovation with regulatory compliance to foster a more secure and efficient market ecosystem. The forward-thinking approach adopted by SEBI reflects a concerted effort to align the Indian securities market with global best practices, ensuring a robust and compliant framework for investor verification.

The Securities and Exchange Board of India (SEBI) has continually evolved its regulatory framework to align with the burgeoning technological advancements and the dynamic global financial landscape. The recent stipulations on Video KYC, as outlined in the Master Circular 2023, showcase a paradigm shift towards a more digital-centric and efficient approach to KYC processes12. This section aims to delve into the nitty-gritty of these guidelines, providing an in-depth analysis of SEBI's Video KYC directives and their implications on KYC Registration Agencies (KRAs) and market participants.

Procedure for Clients with Unvalidated KYC Records: As per the Bombay Stock Exchange (BSE) notification dated 21st April 2023, clients whose KYC records are not validated by KRAs during the validation process are required to get their KYC validated to transact in the securities market. This stipulation ensures a stringent verification process, fortifying the market against potential fraudulent activities and ensuring a high level of compliance3.

Guidelines for KYC Registration Agencies (KRAs): SEBI’s new guidelines delineate the responsibilities of KRAs in verifying and validating the KYC records of clients. Particularly, it mandates KRAs to independently validate KYC records of all clients from 1st July 2023. Furthermore, clients who have completed KYC using non-Aadhaar Officially Valid Document (OVD) will have their records validated only upon the receipt of the Aadhaar number, underlining the importance of Aadhaar in the KYC process4.

Video KYC Verification Process: The Video KYC process entails a remote, in-person verification through video, allowing for a more flexible yet secure method of identity verification. The guidelines advocate for the online submission of officially valid documents and the utilization of electronic or digital signatures, including Aadhaar e-Sign, making the process more streamlined and user-friendly1.

Impact on Operational Efficiency: The shift towards digital KYC, particularly Video KYC, significantly cuts down the operational time and resources previously required for in-person verifications. This not only enhances operational efficiency but also reduces the cost of compliance for financial institutions, thereby fostering a more conducive environment for market growth and investor engagement.

Alignment with Global KYC Norms: SEBI’s Video KYC guidelines resonate with the global trend of leveraging digital technology for compliance purposes. This alignment with international best practices underscores SEBI’s commitment to fostering a compliant and robust market ecosystem, keeping pace with global regulatory advancements.

Technological Infrastructure: The successful implementation of Video KYC necessitates a robust technological infrastructure, ensuring data security, privacy, and seamless operations. The guidelines accentuate the importance of having secure and reliable systems in place, safeguarding against potential cybersecurity threats and ensuring the integrity and confidentiality of client information.

Through a meticulous analysis of SEBI's Video KYC guidelines, it is evident that the focus is on melding technological innovation with regulatory compliance to foster a more secure and efficient market ecosystem. The subsequent sections will further explore the impact of these guidelines on market stakeholders and provide a comparative analysis with global KYC standards, elucidating the progressive stride taken by SEBI in bolstering market compliance and integrity.

The unveiling of SEBI's Video KYC guidelines is a significant milestone in the ongoing digital transformation journey within the Indian financial market. These guidelines, by embracing technological advancements in the KYC domain, have far-reaching implications for various market stakeholders, ranging from financial institutions to individual investors. This section explores the multifaceted impact of these guidelines on market stakeholders, underlining the benefits and challenges brought forth by this regulatory update.

Enhanced Compliance and Transparency: The digital-centric approach to KYC, as outlined in the new guidelines, underscores the move towards a more compliant and transparent market ecosystem. By mandating digital KYC processes including Video KYC, SEBI aims to bolster the integrity of the market, thereby instilling greater confidence among investors and other market participants12.

Operational Efficiency: The adoption of Video KYC significantly streamlines the verification process, reducing the operational time and resources traditionally required for in-person verifications. Financial institutions stand to benefit from improved operational efficiency, which in turn, translates to reduced compliance costs and faster client onboarding.

Enhanced Investor Experience: Investors are poised to experience a more user-friendly and expedient KYC process, courtesy of the Video KYC guidelines. The ease of remotely completing the KYC process, coupled with the reduced time taken for verification, significantly enhances the overall investor experience, thus potentially attracting more participants to the securities market.

Data Security and Privacy Concerns: While the digital KYC processes bring about operational efficiencies, they also raise pertinent questions regarding data security and privacy. The reliance on digital platforms necessitates robust cybersecurity measures to safeguard sensitive client information against potential threats. The guidelines emphasize the importance of having secure and reliable systems in place, underscoring the criticality of data security in the digital KYC journey3.

Global Alignment: SEBI’s Video KYC guidelines echo the global trend of leveraging digital technology for compliance purposes, aligning India’s financial market with international best practices. This alignment not only enhances the global competitiveness of India's financial market but also augments its appeal to foreign investors seeking compliant and technologically advanced markets for investment.

Technological Infrastructure Requirements: The successful implementation of Video KYC hinges on the availability of robust technological infrastructure. Financial institutions will need to invest in secure and reliable systems to facilitate the seamless execution of digital KYC processes, underlining the importance of technological readiness in embracing the new regulatory guidelines.

The financial markets across the globe are at different junctures in their journey towards digital transformation, with varying approaches to KYC norms. The advent of SEBI's Video KYC guidelines places India on the global map as a progressive market adopting digital mechanisms for compliance. This section endeavors to draw a comparative analysis between India's KYC norms, as dictated by SEBI's recent guidelines, and global standards and practices in KYC verification.

Alignment with FATF Recommendations: The Financial Action Task Force (FATF), an inter-governmental body, sets the global standards for combating money laundering and terrorist financing. One of the key recommendations of FATF is the adoption of effective KYC procedures by financial institutions. SEBI’s Video KYC guidelines resonate with these recommendations, emphasizing digital verification methods to ensure a secure and compliant market ecosystem.

Comparison with EU’s AMLD5: The European Union's Fifth Anti-Money Laundering Directive (AMLD5) also advocates for stringent KYC and Customer Due Diligence (CDD) processes. Unlike the EU, which has a more decentralized approach to KYC with varying practices across member states, India’s centralized guidelines under SEBI ensure a uniform approach to KYC processes across the financial market.

Digital KYC Adoption Globally: Countries like the United States, Singapore, and Australia have also embarked on the digital KYC journey, each with their unique regulatory frameworks. The US, for instance, has a well-established framework for electronic signatures and online verification, whereas Singapore has leveraged blockchain technology for KYC processes. SEBI’s guidelines reflect a balanced approach, melding digital verification with regulatory compliance, akin to the practices in these developed markets.

Video KYC Adoption: The adoption of Video KYC is a progressive step that finds parallels in several other jurisdictions. For instance, the Monetary Authority of Singapore has endorsed the use of digital KYC processes, including video conferencing for identity verification. Similarly, countries like the UK and Canada are also exploring video-based KYC verification, showcasing a global trend towards leveraging technology for compliance.

Technological Infrastructure: The requirement for robust technological infrastructure for Video KYC is a common theme across global markets. The emphasis on data security, privacy, and cybersecurity measures is a universal concern, resonating with SEBI’s guidelines that stress the importance of secure and reliable systems for digital KYC processes.

The realm of financial markets is perpetually evolving, driven by a blend of regulatory advancements and technological innovation. SEBI's newly introduced Video KYC guidelines epitomize this evolution, marking a significant stride towards fostering a more secure, compliant, and digitally advanced market ecosystem in India. Through a meticulous exploration of these guidelines, this blog has endeavored to provide a holistic understanding of the procedural, operational, and compliance facets encapsulated in the new KYC norms.

The SEBI Video KYC guidelines 2023 reflect a progressive regulatory framework that not only enhances the ease of doing business but also aligns India’s financial market with global best practices. The emphasis on digital KYC processes, particularly Video KYC, is a testament to SEBI’s commitment to leveraging technological innovation for bolstering market integrity and operational efficiency. The guidelines delineate a clear pathway for financial institutions, KYC Registration Agencies, and other market stakeholders to navigate the digital KYC landscape, ensuring a seamless transition towards a more modernized and user-friendly KYC process.

Furthermore, the comparative analysis with global KYC norms underscores the alignment of India's KYC guidelines with international standards, portraying a positive outlook for India's financial market in the global arena. The comprehensive analysis provided in the preceding sections elucidates the broader implications of these guidelines, offering readers a well-rounded perspective on the SEBI Video KYC guidelines 2023.

In conclusion, the SEBI Video KYC guidelines are a commendable initiative towards melding regulatory compliance with digital innovation, setting a robust foundation for a secure and efficient market ecosystem. As the Indian financial market continues to evolve, the insights gleaned from the analysis of these guidelines offer a valuable blueprint for navigating the regulatory landscape, thus fostering a conducive environment for market growth and investor participation.

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo