For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

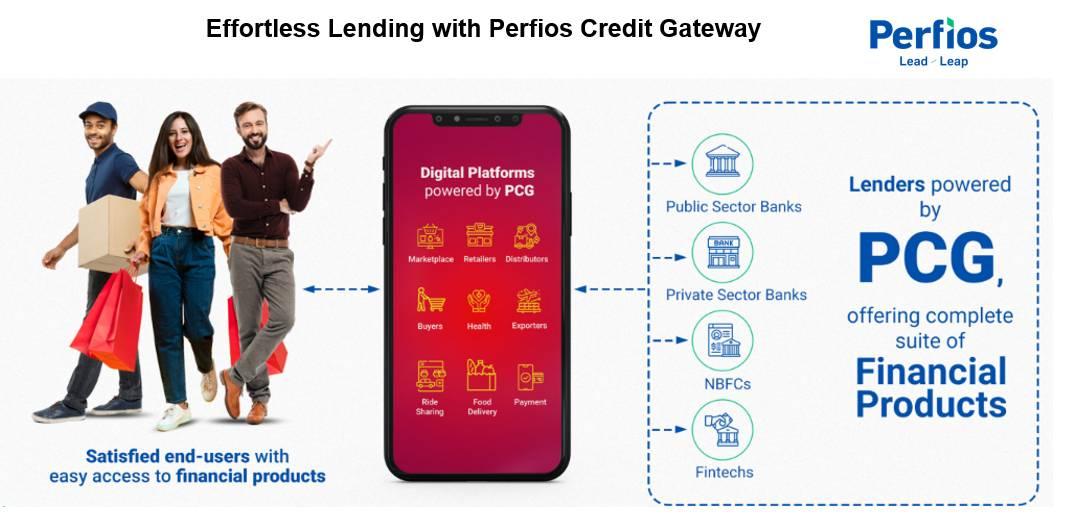

In the landscape of modern e-commerce, marketplaces and digital platforms have become the cornerstone of economic growth, facilitating seamless transactions and fostering connections between businesses and consumers. However, integrating credit options into their ecosystems can pose a significant challenge, often involving complex processes and cumbersome integrations. Perfios Credit Gateway (PCG) emerges as a revolutionary solution, empowering marketplaces and platforms with a plug-and-play approach to effortlessly integrate lending functionalities within their existing infrastructure.

PCG facilitates seamless interactions between lenders and digital platforms, ensuring efficient credit disbursal processes. In this article, we delve into the intricate workings of PCG, its integration with the Open Credit Enablement Network (OCEN), and the transformative benefits it offers to marketplaces.

Perfios Credit Gateway (PCG) represents a cutting-edge solution that streamlines lending operations for both traditional financial institutions and digital marketplaces & platforms. Compliant with the Open Credit Enablement Network (OCEN) and the Open Network for Digital Commerce (ONDC), PCG serves as a secure, white-labeled integration hub, offering scalable embedded finance APIs. Its primary objective is to accelerate the go-to-market strategies for small and medium enterprises (SMEs) and retail businesses by facilitating secure credit transactions between lenders and digital marketplaces.

At the heart of PCG lies the integration with the Open Credit Enablement Network (OCEN), a revolutionary initiative within the India Stack ecosystem aimed at democratizing access to credit across the country. OCEN aims to democratize credit access by establishing common standards and APIs that enable seamless connectivity between lenders and digital platforms. This eliminates the need for individual, time-consuming integrations, streamlining the lending process and significantly reducing associated costs.

Account Aggregator (AA) plays a crucial role in this ecosystem by securely sharing essential financial data with lenders upon customer consent. With the customer's consent, AAs securely retrieve essential customer information such as account statements and GST returns. This information is crucial for lenders to assess creditworthiness and make informed lending decisions. This streamlined approach replaces the traditional, cumbersome underwriting processes, paving the way for efficient credit disbursal.

In the OCEN ecosystem, lenders, including banks, NBFCs, and small finance banks, provide the necessary capital and core banking networks. On the other hand, digital platforms, such as marketplaces, retailers, distributors, and ride-sharing platforms, leverage OCEN to initiate loan processes for their customers/users. PCG acts as a vital bridge between lenders and digital platforms, facilitating seamless interactions and ensuring secure credit disbursal journeys. Through PCG's integration with OCEN's APIs, essential information is shared between digital platforms and lenders, streamlining the entire lending process from application to approval and disbursement.

Beyond streamlining the lending process for marketplaces, PCG unlocks a plethora of benefits. Let us explore how PCG can elevate the operational efficiency of marketplace lending:

PCG empowers marketplaces and digital platforms with seamless integration capabilities, allowing them to connect with multiple lenders effortlessly. This ensures a diverse range of credit options for customers, enhancing the overall user experience.

With PCG's plug-and-play SDK, marketplaces can expedite their go-to-market strategies, reducing the integration time to less than two weeks. This accelerated GTM enables marketplaces to swiftly launch credit offerings, staying ahead in the competitive landscape.

From customer onboarding to disbursement and collections, PCG facilitates the entire lending journey for marketplaces. By providing a holistic solution, PCG ensures seamless operations and enhances operational efficiency for digital platforms.

PCG enables marketplaces to offer in-context credit options at the point of purchase, thereby increasing the order value and driving more significant revenue streams. By integrating credit seamlessly into the purchasing journey, marketplaces enhance customer satisfaction and loyalty.

Through PCG, marketplaces can explore new revenue streams by leveraging lender incentives based on credit disbursals. This incentivizes marketplaces to promote credit offerings, fostering a symbiotic relationship between lenders and digital platforms.

By streamlining lending journeys and offering tailored credit options, PCG enhances customer engagement for marketplaces. Simplified processes and personalized experiences contribute to increased customer loyalty and retention.

PCG ensures robust connectivity with ONDC-authorized Beckn APIs, aligning marketplaces with the evolving digital commerce landscape. The integration with the Beckn Protocol enables decentralized networks for economic transactions, positioning marketplaces for future growth and innovation.

Perfios Credit Gateway (PCG) stands as a transformative force, empowering marketplaces and platforms to offer seamless credit experiences to their customers. By leveraging OCEN and ONDC standards, PCG fosters a more inclusive, efficient, and data-driven lending ecosystem in India. As a result, both lenders and marketplaces benefit from streamlined processes, expanded reach, and enhanced decision-making capabilities, ultimately contributing to the growth and prosperity of the nation's digital economy.

If you want to explore how PCG can impact your digital business, please reach out to us.

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 1000+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com