For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

In the wake of the global pandemic, the banking landscape has undergone a transformation which is driven by shifting customer preferences and the imperative to adapt to a rapidly digitizing world. As the demand for personalized, secure, and digital solutions continues to rise, traditional banks are faced with the pressing need to realign their operations to meet the evolving needs of their customers. Now more than ever, the onboarding process stands as a pivotal juncture in the lending journey, holding the key to forging lasting relationships with customers and ensuring the trust and confidence of lenders from the outset.

In today's lending landscape, Non-Banking Financial Companies (NBFCs) and Fintechs have surged in popularity, particularly among younger borrowers. The allure of NBFCs lies in their streamlined processes and advanced technology, which offer quick turnaround times and a hassle-free experience. Unlike traditional banks with their cumbersome paperwork and lengthy procedures, NBFCs provide tailored loan options for personal and small business financing needs. Despite potential drawbacks like higher interest rates and data security concerns, recent studies highlight the preference for NBFCs due to their convenience and efficiency.

Young borrowers, in particular, are drawn to NBFCs for their speed and convenience, reflecting a broader shift in consumer preferences. With minimal documentation requirements and swift processing, NBFCs stand out for their ability to meet the evolving needs of borrowers in today's fast-paced world. But while borrowing from NBFCs have become the new norm, there are prevalent issues which make the lending process cumbersome.

In the realm of lending, a seamless and friction-free onboarding experience is paramount to forge lasting relationships with customers. It not only sets the tone for the customer's relationship with the lender but also lays the foundation for effective decision-making and risk assessment further down the line.

1. Increased Drop-Off Rates: Non-compliance, a cumbersome user experience and data inadequacy in the onboarding process can lead to frustration among customers, resulting in higher drop-off rates.

2. Hindered Decision-Making: Inadequate data collection and compliance failures during onboarding can impede lenders' ability to gather essential information to assess the borrowers’ creditworthiness for informed decision-making.

3. Elevated Risk Levels: Poor onboarding practices & inadequate KYC measures can contribute to elevated risk levels for lenders leaving them susceptible to fraudulent activities and financial crimes.

4. Diminished Trust and Confidence: A subpar onboarding experience can erode trust and confidence in lenders, undermining the credibility of the institution in the eyes of potential borrowers.

5. Operational Inefficiencies: Cumbersome workflows and manual interventions can hamper operational efficiency, impacting the overall productivity and agility of the lending institution.

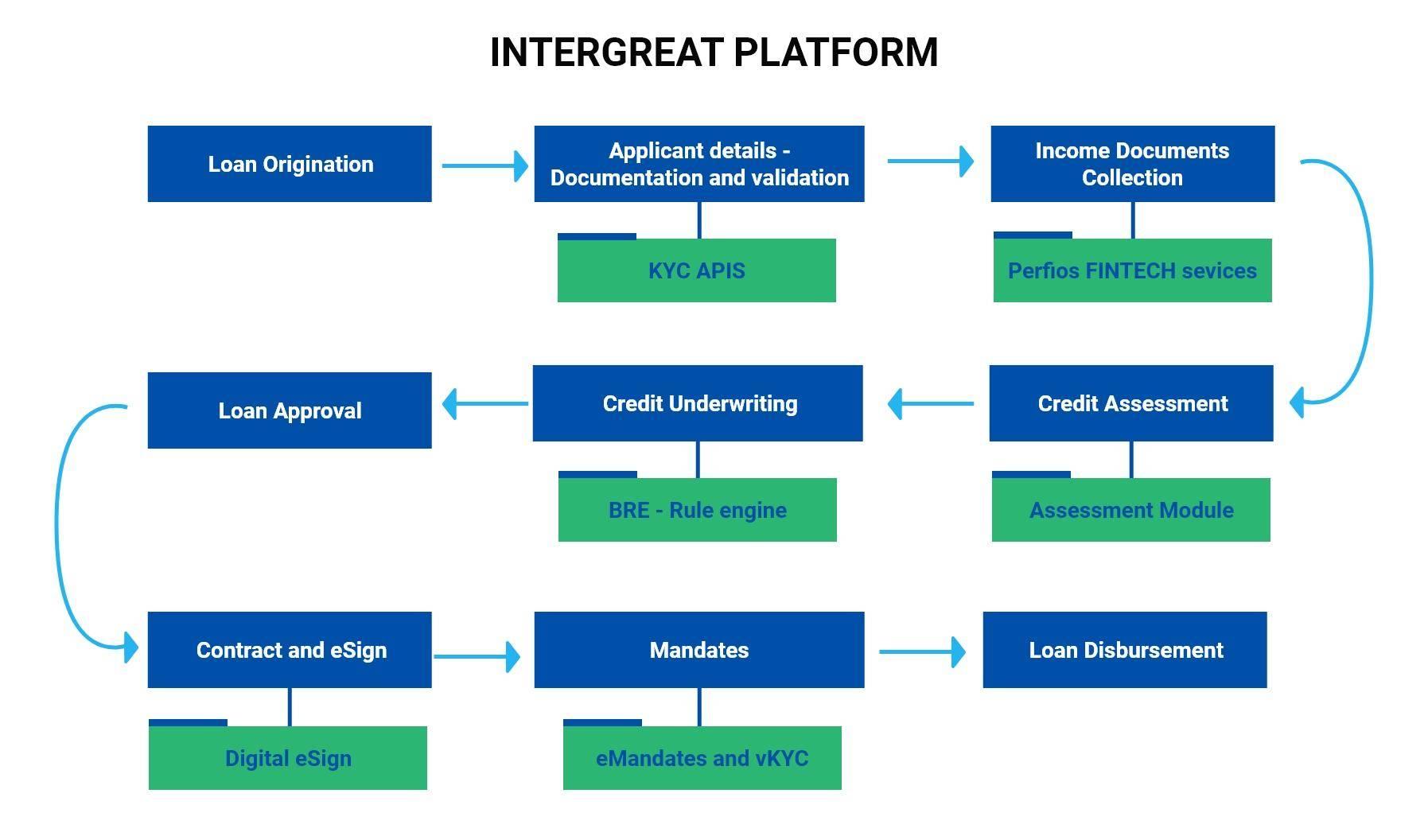

Our groundbreaking loan onboarding platform, INTEGREAT, exemplifies a revolution in banking efficiency. With minimal data input, banks can seamlessly onboard loan customers with the platform’s integrated KYC APIs. This integration ensures seamless onboarding & verification, drastically reducing the time-to-approval (TAT) for loan applications. Moreover, InteGREAT's automation streamlines application fulfillment, minimizes manual errors and expedies the entire credit process.

InteGREAT delivers a seamless experience, empowering customers to easily secure loan approvals. Read on to understand how lenders can harness the platform’s advanced features to offer a seamless onboarding experience for their customers:

1. Instant KYC Verification: Perfios' INTEGreat platform streamlines KYC verification through Perfios KYC APIs, ensuring instant verification and reducing turnaround time (TAT) for loan applications.

2. Automated Credit Process: The entire credit process is automated, minimizing manual effort and errors associated with traditional onboarding methods.

3. AI-Driven Credit Processing: Utilizing advanced AI-driven algorithms, InteGREAT conducts automated bank statement analysis, EPF assessment, cash flow analysis, and VAT/Credit bureau reports & transforms credit processing from days to minutes.

4. Data-Driven Decision-Making: Leveraging Perfios, APIs, InteGREAT enables data-driven decision-making, allowing for better risk assessments, early detection of red flags, and gathering of customer inputs for improved pricing and risk mitigation strategies.

5. Decisioning Business Rule Engine (BRE): Our Decisioning Rule Engine (BRE) enables large banks to automate product-related business rules, facilitating faster and more effective decision-making processes.

6. Curated Credit Scoring: InteGREAT provides lenders with comprehensive product-level credit scoring for a complete picture of borrowers' financial history and enhancing credit decision-making capabilities.

7. Robust Credit Underwriting: We provide assessment modules for product and loan ticket sizes ensure robust credit underwriting, optimizing risk management and lending practices.

8. Pre-Integrated Digital e-Sign and v-KYC: InteGREAT offers pre-integrated digital e-signature and video KYC capabilities, expediting the application process and ensuring a seamless digital journey for customers.

9. Streamlined End-Customer Journey: With InteGREAT, customers benefit from a streamlined and frictionless experience, available both as a direct customer journey and through an assisted journey within the platform. The platform's auto form fill feature, coupled with built-in BRE and assessment tools, ensures a seamless experience in getting loans sanctioned.

10. Hyper-Personalized Analytics: InteGREAT leverages analytics for targeted marketing purposes through hyper-personalization. By analyzing customers' transaction histories, online behavior, demographics, and more, the platform enables lenders to tailor their offerings to individual preferences and needs.

1. Streamlined Loan Processing: The workflow efficiency is enhanced by transitioning to a paperless, simplified, and digitized loan processing cycle,

2. Flexible Deployment Options: Our product supports both Oncloud and on-Premise solutions, ensuring adaptability to the specific needs and infrastructure of your organization.

3. Optimized Workflow: With well-structured application processing and AI-based credit analysis, both banks and borrowers save time and resources through faster approvals and reduced overhead costs.

4. 360-Degree Application View: Inbuilt automated customer identity checks, credit checks, and bank statement analysis provide a comprehensive overview of each application.

5. Consistency and Compliance: Rule-based credit decisioning ensures unbiased decisions and better compliance with regulations.

6. Enhanced User Experience: An appealing and intuitive user interface simplifies customer journeys, making the signup process quick and easy for improved customer satisfaction and retention rates.

7. Centralized Information Management: A centralized and integrated system enables the seamless capture and retrieval of information anytime, anywhere.

Perfios' InteGREAT platform represents a watershed moment in the evolution of loan onboarding. By combining cutting-edge technology with a customer-centric approach, it has redefined the lending experience for both banks and borrowers

Looking ahead, the future of loan onboarding is rife with possibilities. As emerging technologies like blockchain and predictive analytics continue to mature, financial institutions will have access to even more sophisticated tools for risk assessment and decision-making. The potential for innovation in personalized lending solutions is limitless, promising a future where loans are not just products but tailored experiences.

To understand more about the product and to not miss the big wave in loan onboarding technology, you can talk to our team.

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 1000+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo