For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

In the ever-evolving landscape of lending, the customer onboarding journey is undergoing a profound transformation. As financial institutions navigate the complexities of regulatory compliance, risk management, and customer expectations, the imperative for innovation has never been more pressing. At the heart of this evolution lies the concept of digital transformation—by leveraging digital validations and API-first stacks, institutions can minimize errors and expedite the onboarding journey with ease.

By leveraging cutting-edge technologies and embracing a digital-first approach, institutions can streamline operations, enhance risk management capabilities, and deliver a seamless customer experience. From the initial lead entry to the final fund disbursement, every stage of the lending journey stands to benefit from this transformative shift. Moreover, digital transformation holds the promise of enhanced security—a paramount concern in an era of increasing cyber threats and data breaches. By implementing robust security measures and leveraging advanced encryption technologies, institutions can safeguard sensitive customer information and mitigate the risk of fraud.

At the heart of every lending institution lies the onboarding journey, which encompasses various stages such as lead creation, application processing, verification, and sanctioning. Each stage requires meticulous attention to detail to ensure compliance with regulatory requirements and mitigate risks effectively. By understanding the nuances of these stages, institutions can streamline their onboarding processes and enhance overall efficiency.

The specific stages include but are not limited to:

● Initial lead creation

● Application creation

● Identify and KYC verifications/validations

● Income & Employment verifications/validations

● Loan purpose-related checks

● Credit risk and Fraud risk due diligence

● Documentation due diligence

● Execution of applications like agreements, contracts, terms & conditions, collection of charges

● Sanction

● Post-sanction due diligence

● Repayments mandate setup

● Disbursement

Gone are the days when customer onboarding was limited to traditional channels. Today, institutions must cater to diverse sourcing points, including direct-to-customer, relationship manager-led, and channel partner-led journeys. Moreover, the advent of omni-channel approaches has revolutionized the way customers interact with lending institutions, allowing for seamless transitions across multiple platforms and devices.

As financial institutions adapt to the digital age, the concept of straight pass-through (STP) and near-STP (N-STP) journeys emerges as a crucial consideration. STP streamlines the use of payment and routing information, eliminating the need for manual intervention in the onboarding process. Traditionally, sending money involved multiple departments, resulting in lengthy processing times. In contrast, STP enables institutions to expedite transactions with automation, reducing processing times significantly.

However, for complex products and due diligence requirements, near-STP (N-STP) journeys may be necessary. N-STP journeys allow for additional review and scrutiny, ensuring accuracy without sacrificing efficiency. By balancing speed and accuracy, institutions can optimize the onboarding journey for both customers and themselves. In this article, we'll explore how digital transformation and the distinction between STP and N-STP journeys are reshaping the lending landscape, offering insights into the strategies and technologies driving this transformative shift.

Collaboration with third-party agencies and vendors is commonplace in the lending industry, particularly for tasks such as property valuation, legal checks, and personal discussions. In addition to banks or financial institutions (FIs), various external entities play integral roles in the lending journey. These include agencies or vendors contracted by banks/FIs to conduct essential due diligence checks, such as property or collateral valuation, legal assessments, contact point verification (CPV), and personal discussions (PD).

Central to the lending decision-making process is the assessment phase, which relies heavily on customer information gathered from documentation and verification reports. This assessment encompasses evaluating credit and fraud risks, as well as ensuring compliance with legal and regulatory requirements, and safeguarding the institution's reputation.

To streamline this assessment process, institutions often utilize sophisticated tools such as rules engines, AI-based risk scorecards, credit assessment memos (CAM), and credit monitoring arrangements (CMA). These tools enable institutions to automate or semi-automate the preparation of assessments, enhancing efficiency and accuracy.

Following the assessment phase, the execution of sanctions can take various forms, including digital or workflow-based processes. Within banks, authorization matrices govern the sanctioning process, dictating whether approvals are granted at an individual level or through collective decision-making bodies such as forums or committees.

Post-sanction activities, such as contract execution, can also be conducted digitally or manually. These activities encompass setting up repayment mandates, fee collection, fund disbursement, and charge creation, among others. The choice between digital and manual execution depends on factors such as the complexity of the transaction and the institution's technological capabilities.

Modern onboarding journey platforms offer a plethora of features designed to optimize the customer onboarding experience.

These platforms leverage digital technologies and APIs to streamline the onboarding process, allowing for seamless integration with various systems and channels. Microservices architecture enables the decomposition of complex applications into smaller, independent services, facilitating agility, scalability, and easier maintenance.

With a low-code approach, institutions can design and customize onboarding journeys with minimal coding requirements, reducing development time and costs. Configuration-powered platforms offer flexibility in tailoring journeys to specific business needs, allowing for rapid prototyping and iteration.

A modular systems approach enables institutions to build and deploy onboarding journeys in a modular fashion, facilitating scalability and interoperability across multiple products and lines of business.

Pre-integrated solutions eliminate the need for manual integration efforts, enabling seamless connectivity with external systems and data sources. AI, ML, and rules-based automation enhance process efficiency and decision-making by automating repetitive tasks, analyzing data patterns, and enforcing business rules.

These platforms prioritize security, implementing robust measures to safeguard sensitive customer information and ensure compliance with regulatory requirements. With features such as encryption, access controls, and audit trails, institutions can mitigate the risk of data breaches and maintain trust with customers and regulatory authorities.

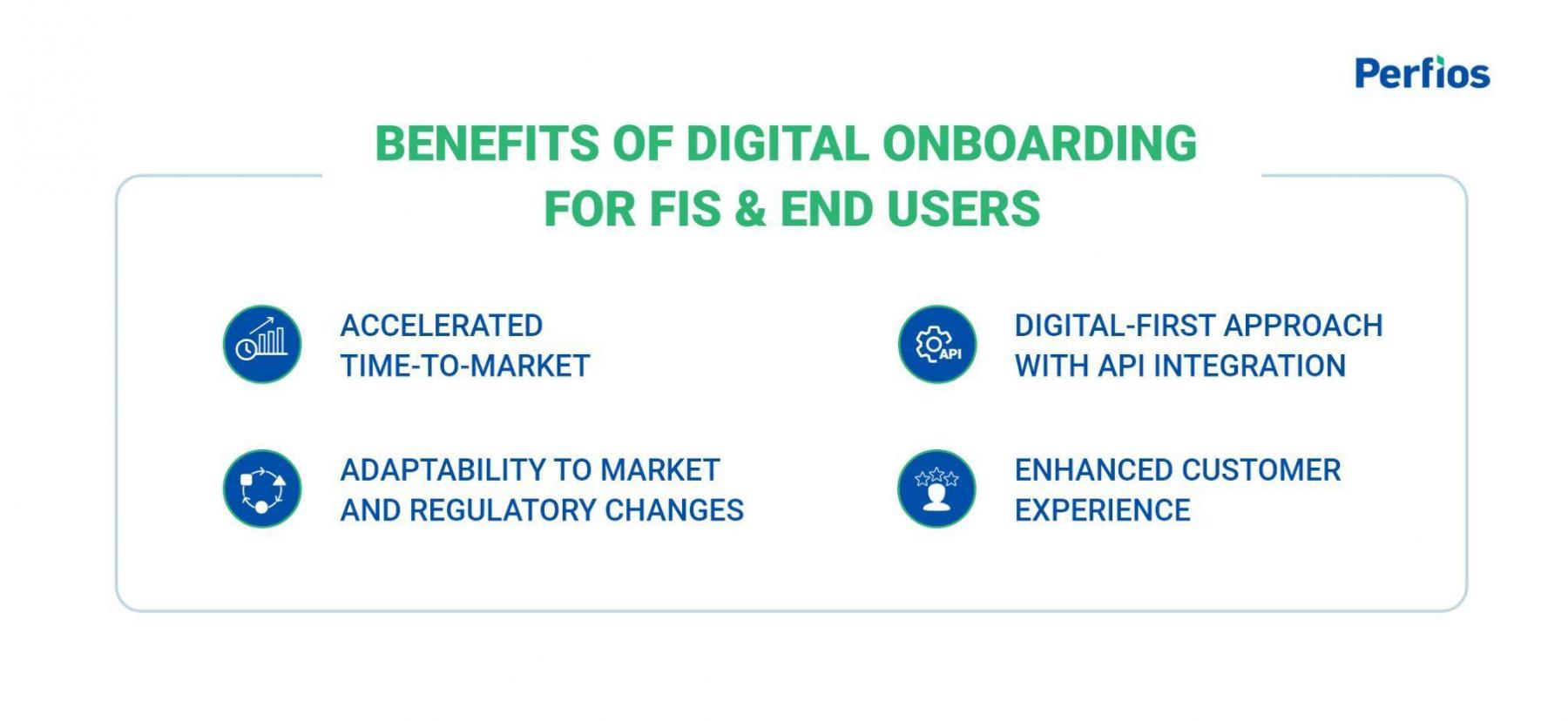

These are a few ways in which digitization can have an impact on elevating the onboarding experience for FIs and customers:

By developing lending journeys swiftly, institutions gain a competitive edge by shortening the Go-to-Market (GTM) time. Product journeys can be created in weeks rather than months, enabling institutions to meet evolving customer needs and market demands more rapidly.

Leveraging a digital and API-first stack enhances efficiency for both banks and financial institutions (FIs) while maintaining a superior customer experience. Digital validations from reliable sources reduce processing time and minimize the risks and errors associated with manual validations.

The platform's flexibility allows institutions to adapt quickly to market shifts and regulatory requirements. Configurable journeys enable seamless incorporation of changes, ensuring compliance and competitiveness in a dynamic landscape.

The platform prioritizes a superior customer experience by offering a user-friendly interface with minimal clicks and optimal processing. Features such as auto-fill of relevant customer information from digitally verified sources streamline the onboarding process, reducing manual data entry and ensuring a frictionless experience for both end customers and institutions.

Revolutionizing customer onboarding in lending requires a holistic approach that encompasses technology, collaboration, and a customer-centric mindset. By embracing modern strategies and leveraging cutting-edge technologies, institutions can streamline their onboarding processes, mitigate risks, and deliver a superior experience to customers.

Ultimately, the impact of digital onboarding extends beyond operational efficiencies—it's about empowering institutions to forge deeper connections with their customers, driving loyalty, satisfaction, and ultimately, growth. As we navigate the complexities of the lending industry's digital transformation journey, one thing remains clear: the future belongs to those who embrace innovation with open arms and a steadfast commitment to delivering value to both end customers and financial institutions alike.

InteGREAT is a highly configurable and powerful end-to-end digital loan origination, servicing, and loan management platform. It ensures scalability across multiple Lines of Business (LOBs) & Domains. The platform automates everything from pre-screening, onboarding, verification, risk and credit review, underwriting, approval, and disbursement to collection.

To know more about how Perfios’ InteGREAT can help your institution scale up and enhance its onboarding practices, please reach out to us at connect@perfios.com