For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

Form filling is one of the biggest contributors to customer abandonment during the application and onboarding journeys for financial products. Surveys estimate that 81% of leads that encounter a form abandon it and 67% never return to the form filling journey. Perfios acknowledges this problem to our customers’ lead generation and user experience, and addresses the problem for them through our Automated Form Fill solution. This solution enables single-input, single-click onboarding for our customers and ensures 100% accurate data aggregation and extraction for MSME business and management details.

Automated form fill is our one-stop solution for all form filling journeys for businesses. The conventional manual data entry is replaced with a seamless, intelligent system that uses a single identifier—be it PAN, GSTIN, CIN, LLPIN, EPF Est ID, UDYAM, IEC, etc and auto-fills 2000+ data points across authenticated 750+ government data sources, all using a single API.

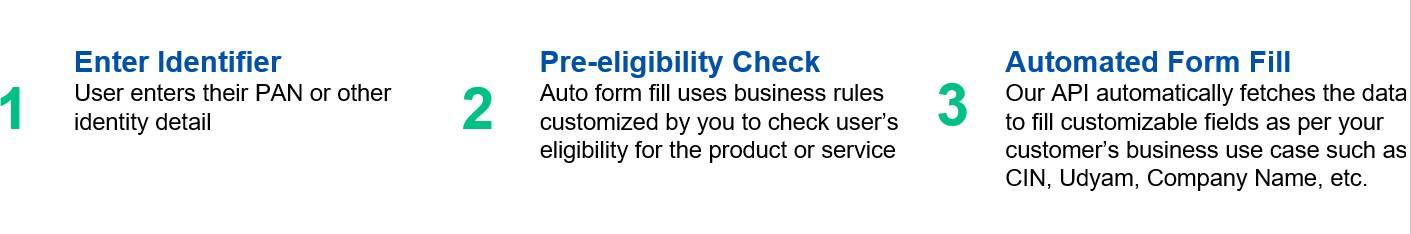

A simple three step process for every form that requires only one actual manual input from the user. Clients can configure what the output will look like to their customers and partners as per their business use cases.

The form fields can be customized to your use case and user journey, allowing you to scalably automate onboarding for all your products.

This automation opens up the policy of instantaneous onboarding for multiple business journeys:

1. MSME lending

2. Merchant Onboarding

3. CASA Opening

4. Corporate credit card application

5. GST overdraft application

Industries that can revolutionize their onboarding processes include:

1. Financial Service Providers

2. Financial Advisory

3. Banks and NBFCs

4. Insurance Companies

5. E-commerce Companies

6. Fintech Companies

7. MSME Lenders

- Pay as you go: Clients only pay for the data points configured and utilized, ensuring optimal cost efficiency. This approach enables lenders to scale their usage based on specific needs and use cases, making it an economical choice.

- Lead filtering: Our business rules engine eliminates the need for lead qualification at the very start of the onboarding process with customizable pre-eligibility checks.

- Comprehensive source coverage: We have integrated with 750+ source databases and profiled 27 million+ businesses, enabling you to seamlessly integrate form fill with the rest of our API ecosystem.

- Choose your data source: We allow you to choose the source from which you primarily require data, preventing unwanted information download time and cost.

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 1000+ FIs to take informed decisions in real-time. Headquartered in Bangalore, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com