For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

As the workforce in India welcomes Gen Z and the rising Gen Alpha, a notable transformation in consumer behavior and consumption trends is evident.

Gen Z marked the beginning of a generation in India unfamiliar with the artificial scarcities prevalent in the pre-liberalization era. On the other hand, Gen Alpha represents the inaugural cohort of Indians who have never experienced a world devoid of the internet, smartphones, apps and e-commerce.

It is estimated that India has about 80 mn unique investors as of September 2023. This number has grown by about 60% in the last three years. At a household level, it is estimated that 50 mn households now have exposure to equity markets which is approximately 17% of the total number of 300 mn households[1].

Of the last 10 million new PAN based investor additions, around 45 per cent has been from cities beyond the top 100 with the northern states leading at 43 per cent share in the first-time investors, followed by west and south at 27 per cent and 17 per cent, respectively.

Growing economy also means the growth of HNWIs. In 2011 for example there were 251,000 HNWIs in India. This number grew to a staggering 7.9 lakh persons in 2022 and is expected to rise to 16.5 lakh, growing 107% in the five year period.

Combined with the rise of digital technologies and regulatory reforms, the wealth and securities industry is looking at significant changes and growth in the next few years.

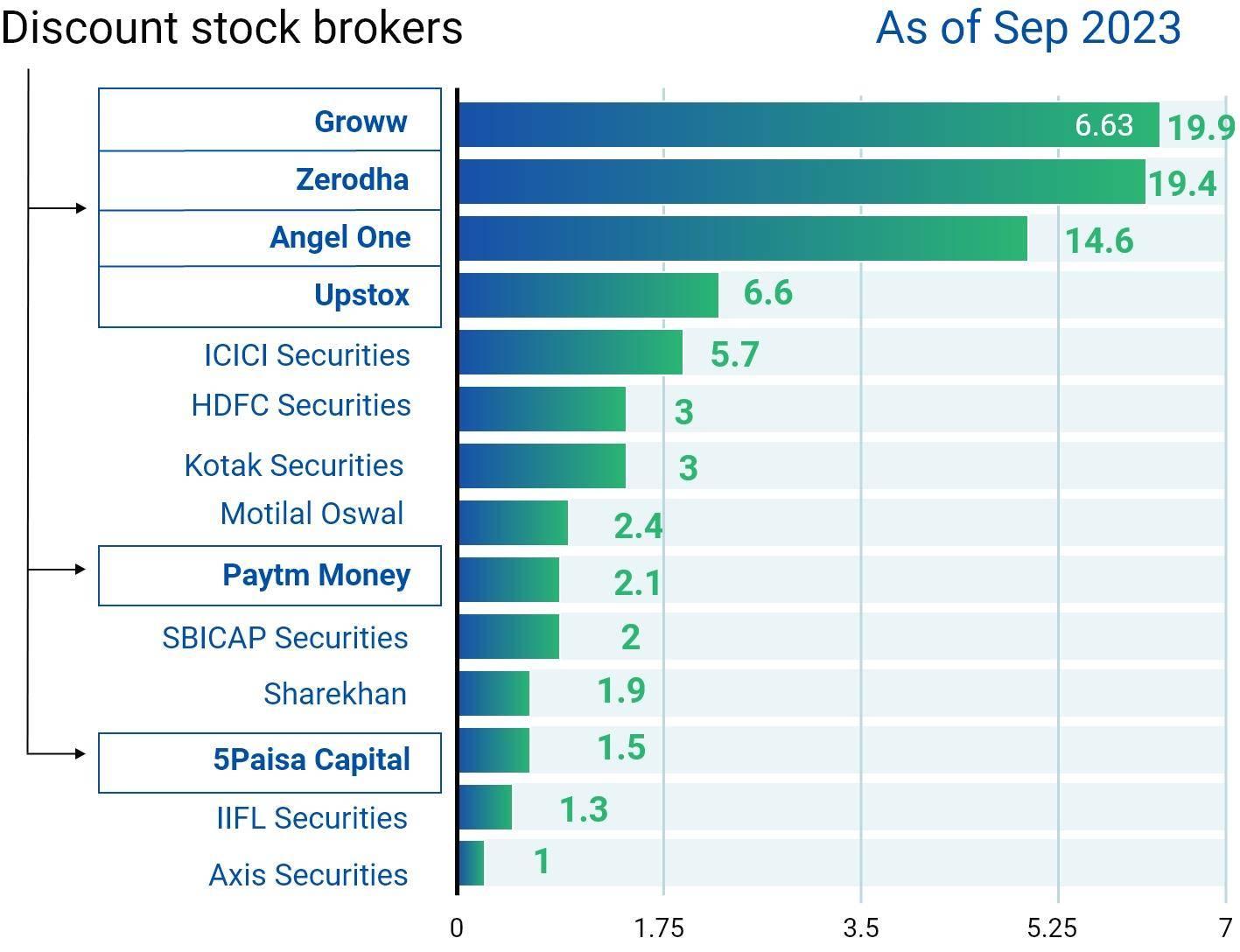

The ripple effects of videoKYC adoption, addition of digital native generation and app based economy in the industry is quite evident from how the new age discount brokers like Zerodha have grown and managed to capture significant marketing share from the traditional service providers.

The next phase of the growth though would depend on how well each of these players understand their customers requirements and personalise their offerings to meet customer lifestyle.

One significant way this can be achieved is by using the AA framework that allows service providers access relevant customer information to truly understand customer behaviour.

With the coming of AA, all financial data of an individual – bank statements, fixed deposits, insurance & investments – will be available in one place with a simple consent mechanism. The availability of financial data on a single screen can be a veritable game changer for those organizations which can leverage this data & build delightful customer experiences.

With access to this consolidated data, wealth managers can gain a deeper understanding of their clients' financial situation, risk appetite, and investment goals. This enables them to provide personalised financial advice tailored to each client's unique circumstances, preferences, and risk tolerance.

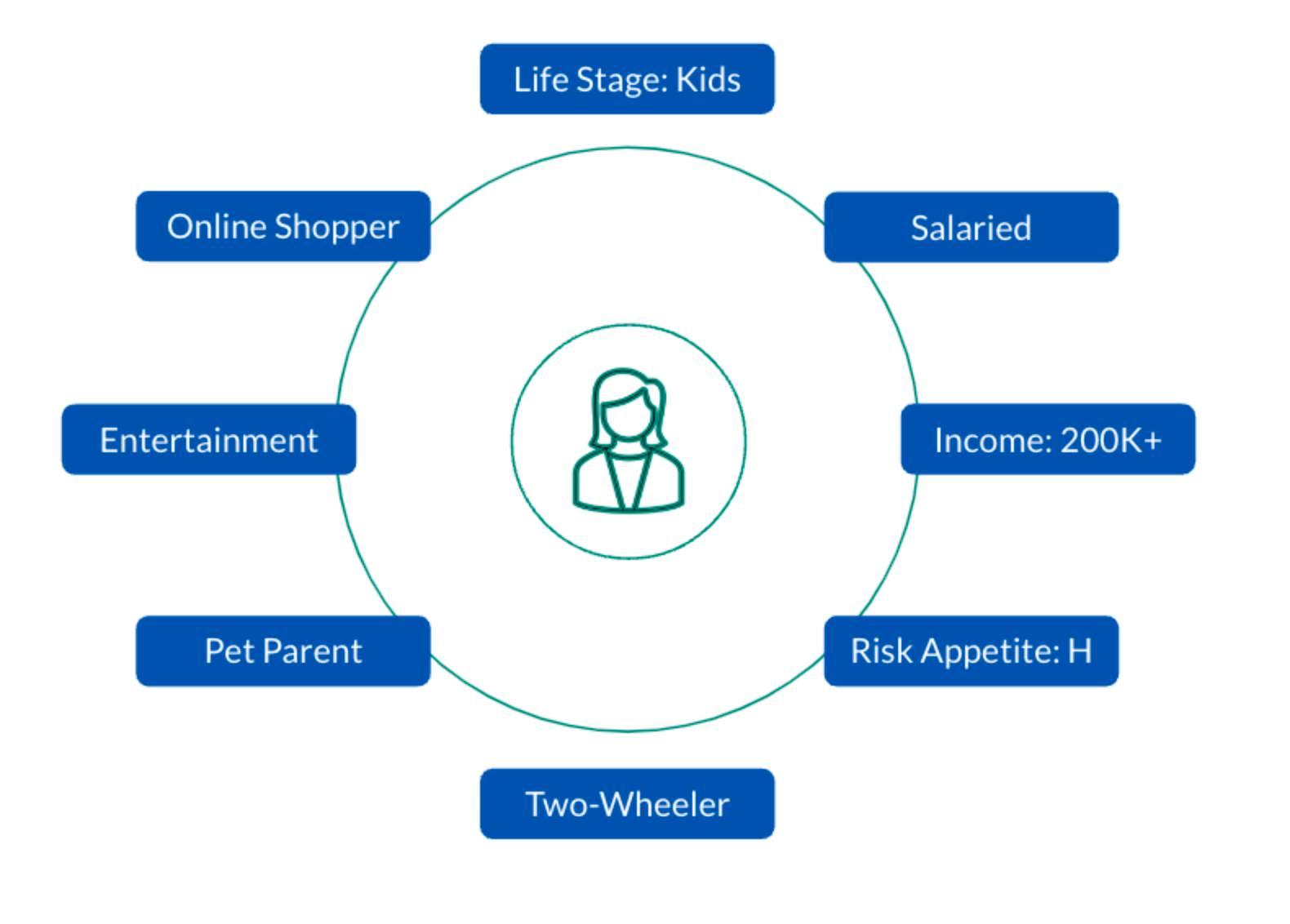

The first step to leverage this is by creating a detailed 3600 Customer Profile that can provide valuable insights into their clients' financial behavior and preferences.

Sample 3600 Customer Profile

These profiles can include:

● Investor classification: Categorizing clients as investors, savers, growers, or spenders based on their investment patterns and risk appetite.

● Life stage analysis: Understanding the client's life stage, such as a young professional, family with children, or nearing retirement, to align investment recommendations with their specific needs and goals.

● Income and net worth estimation: Estimating the client's income and net worth to determine the appropriate level of investment and provide tailored financial advice.

● Asset ownership analysis: Understanding the client's existing portfolio composition, including asset allocation, investments, and risk profile.

● Spend-to-income ratio and categorization: Analyzing the client's spending habits, including discretionary and obligatory expenses, to provide personalised budgeting and financial planning guidance.

A 3600 Customer Profile can then be used to suggest investment opportunities that would match the customer’s lifestyle and goals. Or used as inputs to the Wealth Manager’s Robo Advisory platform. This not only would drive revenue but also makes sure that each customer is given the right advice at the right time, ultimately driving a delightful customer experience.

Leveraging Account Aggregator AA data for customer profiling offers a multitude of benefits for both clients and wealth managers:

AA-based profiling provides wealth managers with a deeper understanding of their clients' financial situation, risk appetite, and investment goals. This comprehensive understanding enables wealth managers to tailor their services and recommendations more effectively. This also means the clients can now get a consolidated view of their financial data across institutions, eliminating the need to manually aggregate information from various sources. This single view simplifies financial management, enabling clients to make informed decisions with greater ease.

Wealth managers can personalise interactions and recommendations based on individual client profiles, fostering stronger client relationships. This personalised approach builds trust and loyalty, leading to long-term client engagement.

For clients this means each offer they get is specifically built by taking into consideration their current financial profile and goals.

Understanding client profiles enables wealth managers to effectively cross-sell and upsell appropriate financial products and services. This targeted approach ensures that clients receive the most relevant and valuable solutions for their specific needs.

Personalised service and tailored recommendations lead to increased client satisfaction and loyalty. This loyal client base contributes to business growth, stability, and long-term success for wealth managers.

As AA continues to mature and adoption expands, wealth managers must adapt their strategies to fully embrace the transformative power of personalised financial services. By investing in data analytics, AI-driven recommendations, and personalised communication channels, wealth managers can position themselves as trusted advisors and partners in their clients' financial journeys

The future of wealth management lies in delivering exceptional client experiences that are rooted in deep understanding, personalised solutions, and proactive guidance.

By leveraging customer profiling insights derived from AA data, wealth managers can provide a more comprehensive, personalised, and value-added experience for their clients. This shift will not only enhance client satisfaction and loyalty but also drive business growth and sustainable success in the evolving wealth management landscape.

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo