For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

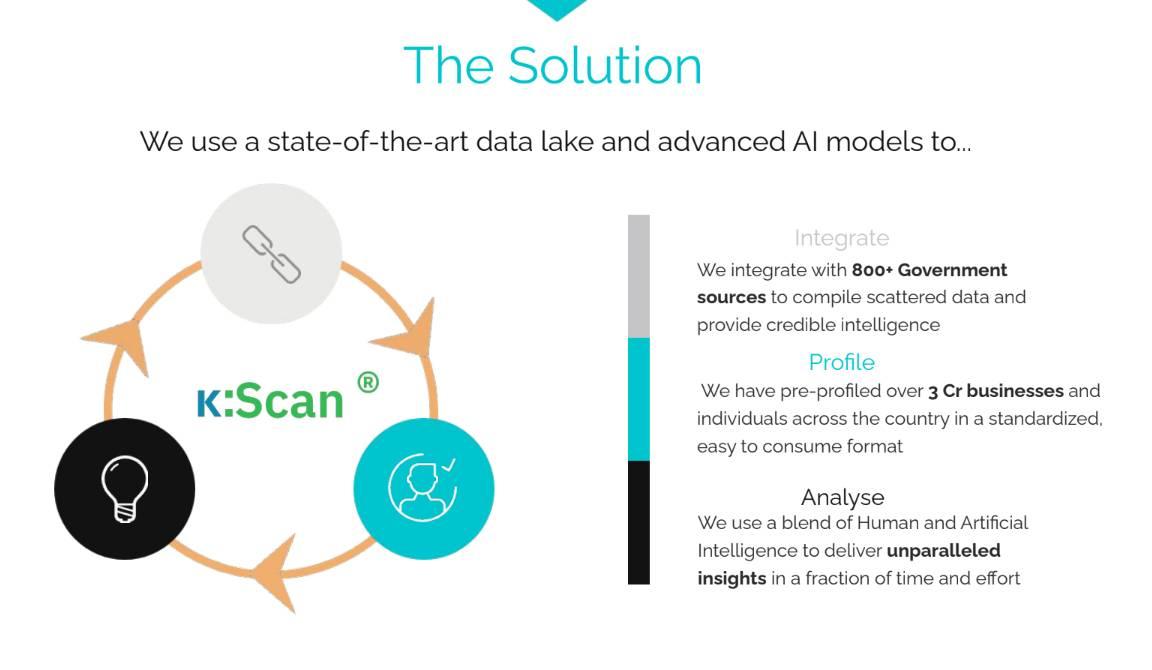

Every business that serves and collaborates with other businesses at any point in time benefits from comprehensive business intelligence regarding their financial and legal status before and during their business relationship. The biggest hindrance to completing these activities today is the scattering of entity data across multiple sources and its disorganized, non-standardized nature, which makes it difficult to analyze this data efficiently for decisioning.

Perfios presents an API-based application which helps companies search out potential new business customers, verify their financial statements, gather insight into litigations against them or their management, and complete onboarding due diligence. KScan gathers, categorizes, analyzes and represents this information in a single dashboard, letting your business focus only on one window for the final go-no-go decisions.

At Perfios, we believe that extensive knowledge and security are the most important determining factors for our clients’ success. To enable this, we have integrated KScan with more than 800 data sources that are constantly updated in the public domain. In fact, we are the only service provider of our kind in the market who can pull MCA (Ministry of Corporate Affairs) data. We have the capability to enable consent-based data gathering for non-MCA registered entities like sole proprietorships, LLPs and more in addition to public domain information about MCA registered companies. Most importantly, our databases are updated constantly to provide the best ongoing business coverage.

This functionality allows our clients to understand detailed business demographics and management profiles. A simple search reveals consolidated information regarding incorporation details, industry classifications, details of statutory registrations and compliances (PAN,TAN, Udyam,etc), shareholding patterns and profiles of current signatories and former management.</p

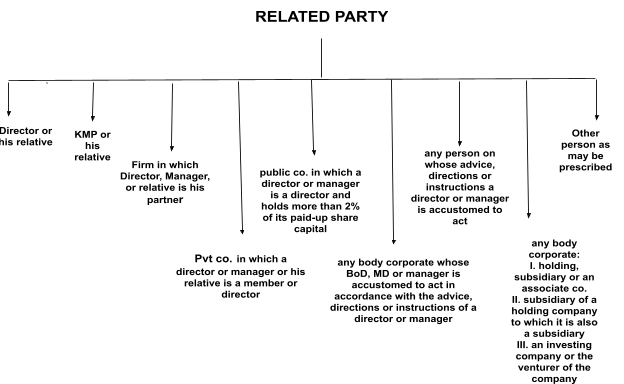

Identify and scrutinize the direct relationships between companies and their management. Our solution maps over 2 billion relationships across more than 3 crore entities and individuals. You may search for relationships using multiple known parameters viz. Directors, shareholders, subsidiaries, etc.

Additionally, you may search for undisclosed links using more than 21 unique parameters. We provide the capability to display up to 4 levels of relationships through a comprehensive network graph that allows an easily comprehensible visualization of various relationships and associated risk severity.

A detailed financials section provides in-depth intelligence around the financial health of the entity. It includes financial analyses of P&L statements, balance sheets, cash flow and ratios, borrowings and investments, listed company information including updates on income, share price, insider training, etc., and listing of latest MCA filings.

We provide 90+ alerts across categories including regulatory, statutory, banking defaults, credit ratings and auditor remarks. Get details of banking defaults including suits filed, assets under auction, BIFR, IBBI, DRT and cheque bounce cases. What’s more? All these risks are presented on a single screen with severity classifications.

Identifying ideal customers for your product can be difficult. To ensure high ROI on marketing and low CAC, you need tight targeting and qualified lead details. Existing digital models focus on broad targeting to provide a higher number of results. The generated leads are very often unqualified and don’t completely adhere to the criteria you specify. This can quickly become expensive when you bring a new product to market and are still figuring out your ideal customer profile. Achieving high conversion can become a nightmare without precise targeting.

Even if you find your ideal customer and pay for contact details, the data is often outdated and unusable. KScan Lead Gen is a tool which allows you to generate leads according to the strict criteria you specify using our custom filters, and lets you pay only if you view the contact details of your target.

This is an especially useful tool for financial service providers providing MSME loans, CASA, group insurance and corporate credit cards.

We provide a KScan-enabled add-on service which delivers details of newly registered businesses and directors with contact information delivered to your Inbox at 8:30 AM on the day after their registration. This lets you beat the competition to contact these companies who would benefit from your offerings.

Important as it is for any company to perform due diligence on individual customers in the form of KYC, it is equally important for businesses to perform KYB or Know Your Business on partners, business customers and vendors. The ever-increasing sophistication of financial crimes and regulations around them necessitates KYB tech enablement for B2B and B2C companies. KYB checks can help mitigate financial penalties, cross-jurisdictional regulatory enforcement and reputation loss. Most importantly, they help companies meet their moral obligation to prevent the financing of criminal activities around the world including money laundering, terrorism, drug trafficking, bribery and corruption. KScan enables multiple KYB checks including:

- Politically Exposed Person (PEP)

Politically Exposed Persons are at a higher risk of being involved in financial crimes such as bribery and corruption. The PEP Database platform aggregates data on the financial, professional and personal profiles of PEPs across several sources with varying data points available to create:

a) A profile for the Members of Parliament, Members of Legislative Assemblies and Councils, public servants i.e., IPS and IAS Officers, Members of the Judiciary, and so on.

b) network of entities and businesses associated with PEPs, their relatives etc.

- Anti-Money Laundering (AML) Sanctions screening

Our Anti-Money Laundering AML Sanctions Screening API allows you to screen and identify individuals and entities that are sanctioned under any International Sanctions list, including sanctions lists published by authorities such as the United Nations, Foreign Assets Control, Interpol, Central Bureau of Investigation, World Bank, National Investigation Agency. This API aggregates data from International and Indian sanctions lists to help our clients comply with the provisions of the Prevention of Money Laundering rules and other applicable laws. We cover a wide variety of lists including a wide variety of lists including OFAC, INTERPOL, UN, CBI, IHMA, COFEPOSA, NIA, Australia, UK, Europe, and WORLD BANK.

Make your onboarding due diligence seamless and robust, be it HR due diligence or management profiling, using our integration to 3500+ courts across India to make legal information from the entire judicial system visible in a single window. Reduce false positives while searching for cases against individuals and companies.

In India, legal due diligence is required before insurance is issued, money is lent, an IPO is launched, new vendors and merchants are onboarded, and more. The manual coalition of litigation data across all Indian courts and tribunals for this purpose are cumbersome and error-prone. Additionally, hiring a new employee can be very time consuming and inefficient if legal diligence is conducted manually.

Litigation BI digitizes your litigation diligence process by eliminating paperwork. It is an ai-powered tool that combines data from 3500+ courts and tribunals across India and generates a comprehensive litigation report at the click of a button. Our comprehensive coverage and daily data updates ensure accurate case identification, tagging, report generation, and analytics.

Any process with a lengthy form to fill sees a high rate of drop offs and the cumbersome and time-consuming process poses a significant challenge for a business to grow. In order to reduce this and simplify the process, we have built a one-stop-solution for all form filling journeys for entities - Auto Form Fill.

Conventional manual data entry is replaced with a seamless, intelligent system that uses a single identifier—be it PAN, GSTIN, CIN, LLPIN, EPF Est ID, UDYAM, IEC, etc and auto-fills 2000+ data points across authenticated 750+ government data sources, all using a single API. This not only expedites the form-filling process but also minimizes errors, ensuring accuracy and compliance. This API caters to and simplifies corporate credit card application, current A/C opening, loan onboarding, GST OD, MSME lending and many more use cases.

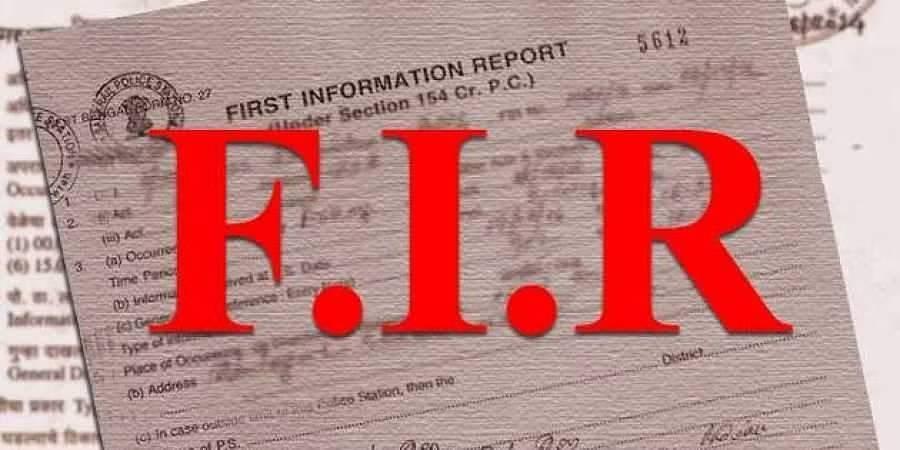

Police Records Check (FIR) is a comprehensive Criminal background verification tool developed to access digital police records on a single platform and perform criminal checks on any individual, across numerous police stations from states in India. The ability to accurately assess the backgrounds of individuals is not just a compliance requirement but a critical component of risk management.

When trying to access information to assess an individual’s criminal character the entities may face several challenges such as fragmented data across multiple police departments, language barriers to read & understand cases, standardizing data to make the information usable, data retrieval costs and timeliness. The tool provides a comprehensive solution for risk assessment, employee screening, claims investigations, tenant verification and KYC compliance.

Through KScan, we process over 20 lakh API calls and process over 1.2 billion records everyday. Employing the various features of KScan, you can ensure the best returns on your marketing and due diligence investments, and do stress-free business knowing that your regulatory compliance is secure. With unmatchable pricing that lets you pay only for the information you use, KScan brings affordable single-window business intelligence to your arsenal.

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in Bangalore, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com